Thursday, April 27, 2023

Understanding Forex Trading Spreads: Choosing the Right Spread for Your Trading Strategy

Understanding the Nexus Between Price Stability, Financial Stability, and Fiscal Sustainability for a Strong Economy

Wednesday, September 23, 2009

Hot Trading Tips & Rules

- Plan your trades. Trade your plan.

- Keep records of your trading results.

- Keep a positive attitude, no matter how much you lose.

- Don't take the market home.

- Forget your College degree and trust your instincts.

- Successful traders buy into bad news and sell into good news.

- Successful traders are not afraid to buy high and sell low.

- Continually strive for patience, perseverance, determination, and rational action.

- Limit your losses - use stops!

- Never cancel a stop loss order after you have placed it!

- Place the stop at the time you make your trade.

- Never get into the market because you are anxious because of waiting.

- Avoid getting in or out of the market too often.

- The most difficult task in speculation is not prediction but self-control. Successful trading is difficult and frustrating. You are the most important element in the equation for success.

- Always discipline yourself by following a pre-determined set of rules.

- Remember that a bear market will give back in one month what a bull market has taken three months to build.

- Don't ever allow a big winning trade to turn into a loser. Stop yourself out if the market moves against you 20% from your peak profit point.

- Expect and accept losses gracefully. Those who brood over losses always miss the next opportunity, which more than likely will be profitable.

- Split your profits right down the middle and never risk more than 50% of them again in the market.

- The key to successful trading is knowing yourself and your stress point.

- The difference between winners and losers isn't so much native ability as it is discipline exercised in avoiding mistakes.

- Speech may be silver but silence is golden. Traders with the golden touch do not talk about their success.

- Dream big dreams and think tall. Very few people set goals too high.

A man becomes what he thinks about all day long.

- Accept failure as a step towards victory.

- Have you taken a loss? Forget it quickly. Have you taken a profit? Forget it even quicker!

- You don't invest ...You will lose.

- You don't manage risks ...You will lose.

- You follow tips ...You will lose.

- You don't investigate before you invest ...You will lose.

- You panic ...You will lose.

- You want to speculate ...You will lose.

- You don't understand your finances ...You will lose.

- You don't use cost averaging ...You will lose.

- You want to play ...You will lose.

- You don't know when not to invest ...You will lose.

- You don't know when not to exit ...You will lose.

- You can't afford to lose ...You can't afford to make a profit.

Saturday, September 19, 2009

Dollar Fails to Rally and Bottoms at One Year Low

Finally the Dollar could no longer hold on to its value and position vis a vis other currencies as it continued to slip down rapidly to finally bottom out to a one year low ,on September 16, last wednesday.

On the other hand, the new Finance minister of Japan was optimistic about Japans economic future, as Japanese Yen reached a seven month high against the dollar, as he considered that a strong Yen is good for Japan.

The Japanese yen to dollar rate fell 0.9% against the yen to a seven month low of 90.13.

The euro to dollar rate hit a nine month high of $1.4715. The last time the euro hit $1.47 was in September 2008.

Some currency experts are predicting the Pound to dollar rate will hit $1.70 in the near future.

Massive US deficits also caused investor concern but higher stocks were the main driver of risk appetite.

With stocks going up, it continues to be very difficult for the dollar to rally.

Traditionally the dollar trades lower when stocks perform well.

Tuesday, September 15, 2009

Dollar Weakens because of US Gross National Debt

The Dollar is now the cheapest currency in the world to borrow, since the Dollar LIBOR rate fell below than the corresponding Japanese rate for the first time in 16 years.

One of the biggest reasons why Dollar is losing value is because of the US National Debt.

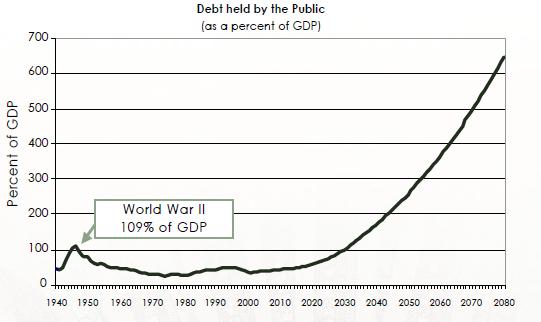

As of today the gross US national debt (Treasury securities) outstanding, stands at $11.4 Trillion.

Of this the debt owed to external parties is probably about $6 Trillion.

Going forward, meanwhile, the latest government projections indicate a $9 trillion increase over the next decade, touching a whopping $20 Trillion in 2020.

In absolute terms, it would smash all previous records, while in real terms (as a percentage of GDP), it would be the largest increase since World War II.

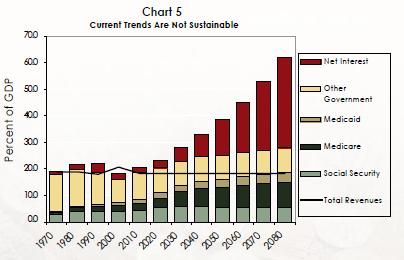

Over the long-long-term, the growth in national debt is projected to be catastrophic, as the baby boomer retirement leads to an explosion in entitlement spending.

Over the long-long-term, the growth in national debt is projected to be catastrophic, as the baby boomer retirement leads to an explosion in entitlement spending.The resulting strain on the system is summarized by the Government Accountability Office: “Without changes, spending for Social Security, Medicare, and Medicaid would permanently and dramatically increase the Government’s budget deficit and debt, leading eventually to renewed financial and economic instability.”

The UN report – the first multinational statement on the issue – argued that dollar’s status as the world’s reserve currency should be subject to reconsideration in light of the major imbalances in global trade that have produced the current financial crisis.

Source:

http://www.forexblog.org/2009/09/dollar-under-pressure-on-all-fronts.html

http://forex.gftforex.com/public/item/239108

Wednesday, September 9, 2009

Margin Trading and its Importance - Forex Basics

In this kind of trading, a minimum amount has to be deposited and maintained in ones account with the Broker of ones choice. This amount in turn is used as leverage money by the broker on behalf of the trader to open positions with higher value, which could be as high as 200 times the amount deposited and thats traded in the market.

This is how Forex traders take control of large amount of currency and trade them in the market by making a marginally small deposit in comparison to the trading amount with which traders play in the market.

It is also one way to ensure the broker from losses if any. This margin money to be deposited with the broker for safe keeping acts as a collateral. Its from this money any loss incurred by the broker is to be compensated by the trader as part of a contingency plan. It sort of acts some kind of a safety net for the broker to offset any loss.

Hence this margin money thats to be maintained in ones account is decided by the broker and which differs from one broker to the other.

However one must exercise caution when trading using margin money to leverage your trading power. One false move can doom your fortune to doldrums, otherwise the prospects are very high if you learn to trade carefully.

The prospects of rise and fall are indeed great in Forex Margin trading. Say for a 1% margin you have to deposit 10,000 USD to trade one million dollars. No wonder a swing of 2% either way can cause a 200% loss or profit.

Thursday, August 28, 2008

Forex Trading Commandments for Success

2. Cut losses with the most strict discipline

3. Make good decisions and winning will take care of itself.

4. When you lose, don't lose the lesson!

5. When in doubt, get out.

6. Keep your risk/reward profile in check.

7. Avoid scheduled news.

8. Consider your account size for appropriate trading.

9. Get a charting program that allows you to build watch lists, sort stocks, and draw trendlines.

10. Scale out of winning positions as they work for you.

11. Don't dig yourself into a hole early in the day or in your career.

12. Trade with a blend of anticipation and confirmation.

13. Evaluate your results at least monthly.

14. Finally (perhaps most important), always be patient.

15. Invest on the side that is winning

16. The objective of what we are after is not to buy low and to sell high, but to buy high and to sell higher, or to sell short low and to buy lower.

17. Capital is in two varieties: Mental and Real, and, of the two, the mental capital is the most important.

18. Markets can remain illogical far longer than you or I can remain solvent.

19. To trade/invest successfully, think like a fundamentalist; trade like a technician.

20. Grow Slowly But Strongly "Pip-Machine"